Financial statements and KPIs - Notes to the 2024 Financial Statements

Notes to the financial statements

1. Basis of preparation

The Commissioner for Children and Young People (CCYP) is a government not-for-profit entity controlled by the State of Western Australia, which is the ultimate parent.

A description of the nature of its operations and its principal activities have been included in the ‘Overview’ which does not form part of these financial statements.

These annual financial statements were authorised for issue by the accountable authority of the CCYP on 30 June 2024.

Statement of compliance

The financial statements constitute general purpose financial statements that have been prepared in accordance with Australian Accounting Standards, the Framework, Statement of Accounting Concepts and other authoritative pronouncements of the Australian Accounting Standards Board as applied by Treasurer’s instructions. Several of these are modified by Treasurer’s instructions to vary application, disclosure, format and wording.

The Act and Treasurer’s instructions are legislative provisions governing the preparation of financial statements and take precedence over Australian Accounting Standards, the Framework, Statement of Accounting Concepts and other authoritative pronouncements of the Australian Accounting Standards Board. Where modification is required and has had a material or significant financial effect upon the reported results, details of that modification and the resulting financial effect are

disclosed in the notes to the financial statements.

Basis of preparation

These financial statements are presented in Australian dollars applying the accrual basis of accounting and using the historical cost convention. Certain balances will apply a different measurement basis (such as fair value basis). Where this is the case the different measurement basis is disclosed in the associated note. All values are rounded to the nearest dollar.

Accounting for Goods and Services Tax (GST)

Income, expenses, and assets are recognised net of the amount of goods and services tax (GST), except that the:

a) amount of GST incurred by the CCYP as a purchaser that is not recoverable from the Australian Taxation Office (ATO) is recognised as part of an asset’s cost of acquisition or as part of an item of expense;

and

b) receivables and payables are stated with the amount of GST included.

Cash flows are included in the Statement of cash flows on a gross basis. However, the GST components of cash flows arising from investing and financing activities which are recoverable from, or payable to, the ATO are classified as operating cash flows.

Contributed equity

Interpretation 1038 Contributions by Owners Made to Wholly Owned Public Sector Entities requires transfers in the nature of equity contributions, other than as a result of a restructure of administrative arrangements, as designated as contributions by owners (at the time of, or prior to, transfer) be recognised as equity contributions. Capital appropriations have been designated as contributions by owners by TI 955 Contributions by Owners made to Wholly Owned Public Sector

Entities and have been credited directly to Contributed Equity.

Comparative information

Except when an Australian Accounting Standard permits or requires otherwise, comparative information is presented in respect of the previous period for all amounts reported in the financial statements. AASB 1060 provides relief from presenting comparatives for.

• Property, Plant and Equipment reconciliations;

• Intangible Asset reconciliations; and

• Right-of-Use Asset reconciliations

Judgements and estimates

Judgements, estimates, and assumptions are required to be made about financial information being presented. The significant judgements and estimates made in the preparation of these financial statements are disclosed in the notes where amounts affected by those judgements and/or estimates are disclosed. Estimates and associated assumptions are based on professional judgements derived from historical experience and various other factors that are believed to be reasonable under the circumstances.

2. Use of our funding

Expenses incurred in the delivery of services

This section provides additional information about how the CCYP’s funding is applied and the accounting policies that are relevant for an understanding of the items recognised in the financial statements. The primary expenses incurred by the CCYP in achieving its objectives and the relevant notes are:

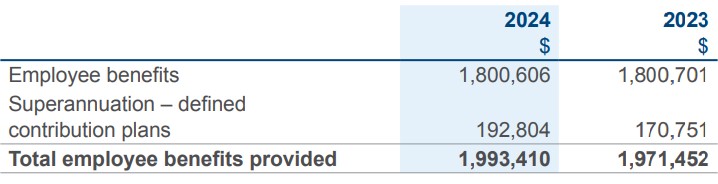

2.1(a) Employee benefits expense

Employee Benefits include wages, salaries and social contributions, accrued and paid leave entitlements and paid sick leave.

Superannuation is the amount recognised in profit or loss of the Statement of comprehensive income comprises employer contributions paid to the WSS, other GESB schemes or other superannuation funds.

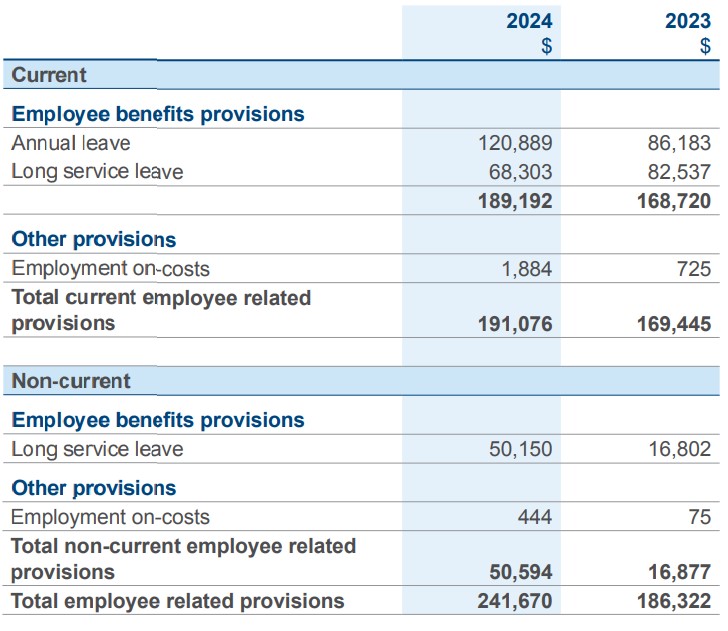

2.1(b) Employee related provisions

Provision is made for benefits accruing to employees in respect of annual leave and long services leave for services rendered up to the reporting date and recorded as an expense during the period the services are delivered.

Annual leave liabilities are classified as current as there is no right at the end of the reporting period to defer settlement for at least 12 months after the end of the reporting period.

The provision for annual leave is calculated at the present value of expected payments to be made in relation to services provided by employees up to the reporting date.

Long service leave liabilities are unconditional long service leave provisions and are classified as current liabilities as the CCYP does not have the right at the end of the reporting period to defer settlement of the liability for at least 12 months after the end of the reporting period.

Pre-conditional and conditional long service leave provisions are classified as non-current liabilities because the CCYP has the right to defer the settlement of the liability until the employee has completed the requisite years of service.

The provision for long service leave is calculated at present value as the CCYP does not expect to wholly settle the amounts within 12 months. The present value is measured taking into account the present value of expected future payments to be made in relation to services provided by employees up to the reporting date. These payments are estimated using the services of an actuarial.

Employment on-costs involve settlement of annual and long service leave liabilities which gives rise to the payment of employment on-costs including workers’ compensation insurance. The provision is the present value of expected future payments.

Employment on-costs, including workers’ compensation insurance premiums, are not employee benefits and are recognised separately as liabilities and expenses when the employment to which they relate has occurred. Employment on-costs are included as part of ‘Other expenses note 2.2 (apart from the unwinding of the discount (finance cost))’ and are not included as part of the CCYP’s ‘employee benefits expense’. The related liability is included in ‘Employment on-costs provision’.

Employment on-costs provision

Key sources of estimation uncertainty – long service leave

Key estimates and assumptions concerning the future are based on historical experience and various other factors that have a significant risk of causing a material adjustment to the carrying amount of assets and liabilities within the next reporting period.

Several estimates and assumptions are in calculating the CCYP’s long service leave provision.

These include:

• expected future salary rates;

• discount rates;

• employee retention rates; and

• expected future payments.

Changes in these estimations and assumptions may impact on the carrying amount of the long service leave provision. Any gain or loss following revaluation of the present value of long service leave liabilities is recognised as employee benefits expense.

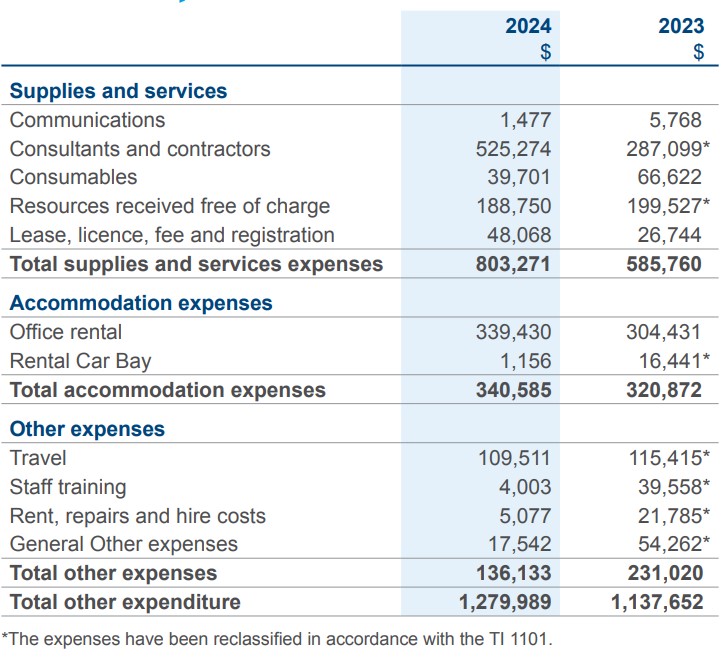

2.2 Other expenditure

Supplies and services expenses are recognised as an expense in the reporting period in which they are incurred. The carrying amounts of any materials held for distribution are expensed when the materials are distributed.

Office rental is expensed as incurred as Memorandum of Understanding Agreement between the CCYP and the Department of Finance for the leasing of office accommodation contain significant substitution rights.

Rent, repairs and hire costs are recognised as expenses as incurred.

General other expenses generally represent the day-to-day running costs incurred in normal operations.

3. Our funding sources

How we obtain our funding

This section provides additional information about how the CCYP obtains its funding and the relevant accounting policy notes that govern the recognition and measurement of this funding. The primary income

received by the CCYP is and the relevant notes are:

3.1 Income from State Government

(See updated table on Erratum page)

Service Appropriations are recognised as income at fair value of consideration received in the period in which the CCYP gains control of the appropriated funds. The CCYP gains control of the appropriated funds at the time those funds are deposited in the bank account or credited to the holding account held at Treasury.

Income from other public sector entities is recognised as income when the CCYP has satisfied its performance obligations under the funding agreement. If there is no performance obligation, income will be recognised when the CCYP receives the funds.

Resources received from other public sector entities is recognised as income equivalent to the fair value of assets received, or the fair value of services received that can be reliably determined and which would have been purchased if not donated.

3.2 Other income

Subsidies are recognised as income when the CCYP obtains control of the funding. The CCYP is deemed to have assumed control when the subsidy is received.

Gain on disposal of a leased asset was from the return of one operational pool vehicle.

4. Key assets

This section includes information regarding the key assets the CCYP utilises to gain economic benefits or provide service potential. The section sets out both the key accounting policies and financial information about

the performance of these assets:

4.1 Plant and equipment

Initial recognition

Items of plant and equipment, costing $5,000 or more are measured initially at cost. Where an asset is acquired for no cost or significantly less than fair value, the cost is valued at its fair value at the date of acquisition. Items of plant and equipment costing less than $5,000 are immediately expensed direct to the Statement of Comprehensive Income (other than where they form part of a group of similar items which are significant in total).

Subsequent measurement

Plant and equipment are stated at historical cost less accumulated depreciation and accumulated impairment losses.

Useful lives

All plant and equipment having a limited useful life are systematically depreciated over their estimated useful lives in a manner that reflects the consumption of their future economic benefits.

Depreciation is generally calculated on a straight-line basis, at rates that allocate the asset’s value, less any estimated residual value, over its estimated useful life. Typical estimated useful lives for the different asset classes for current and prior years are included in the table below:

The estimated useful lives, residual values and depreciation method are reviewed at the end of each annual reporting period, and adjustments should be made where appropriate.

Impairment

Non-financial assets, including plant and equipment, are tested for impairment whenever there is an indication that the asset may be impaired. Where there is an indication of impairment, the recoverable amount is estimated. Where the recoverable amount is less than the carrying amount, the asset is considered impaired and is written down to the recoverable amount and an impairment loss is recognised.

Where an asset measured at cost is written down to its recoverable amount, an impairment loss is recognised through profit or loss.

Where a previously revalued asset is written down to its recoverable amount, the loss is recognised as a revaluation decrement through other comprehensive income to the extent that the impairment loss does not exceed the amount in the revaluation surplus for the class of asset.

As the CCYP is a not-for-profit agency, the recoverable amount of regularly revalued specialised assets is anticipated to be materially the same as fair value.

If there is an indication that there has been a reversal in impairment, the carrying amount shall be increased to its recoverable amount. However, this reversal should not increase the asset’s carrying amount above what would have been determined, net of depreciation or amortisation, if no impairment loss had been recognised in prior years.

4.2 Right-of-use assets

Year ended 30 June 2024

The CCYP does not have any operational vehicles now as it was transferred to Department of Water and Environmental Regulation in September 2023.

The CCYP has entered into a Memorandum of Understanding Agreement with the Department of Finance for the leasing of office accommodation. These are not recognised under AASB 16 because of substitution rights held by the Department of Finance and are accounted for as an expense as incurred.

Initial recognition

At the commencement date of the lease, the CCYP recognises right-of-use assets and a corresponding lease liability for most leases. The right-of-use assets are measured at cost comprising of:

• the amount of the initial measurement of lease liability;

• any lease payments made at or before the commencement date less any lease incentives received;

• Any intial direct costs, and

• Restoration costs, including dismantling and removing the underlying asset.

The CCYP has no short-term leases (with a lease term of 12 months or less) and low value leases (with an underlying value of $5,000 or less).

Subsequent measurement

The cost model is applied for subsequent measurement of right-of-use assets, requiring the asset to be carried at cost less any accumulated depreciation and accumulated impairment losses, and adjusted for any re-measurement of lease liability.

Depreciation and impairment of right-of-use assets

Right-of-use assets are depreciated on a straight-line basis over the shorter of the lease term and the estimated useful lives of the underlying assets.

If ownership of the leased asset transfers to the CCYP at the end of the lease term or the cost reflects the exercise of a purchase option, depreciation is calculated using the estimated useful life of the asset.

Right-of-use assets are tested for impairment when an indication of impairment is identified. There were no indications of impairment to the CCYP’s right-of-use asset.

Read more pages in this chapter

Financial statements and KPIs

Find out moreExplore the 2023-24 Annual Report

Chapters