Financial statements and KPIs - Notes to the 2024 Financial Statements (continued)

Notes to the financial statements (continued)

5. Other assets and liabilities

This section sets out those assets and liabilities that arose from the CCYP’s controlled operations and includes other assets utilised for economic benefits and liabilities incurred during normal operations:

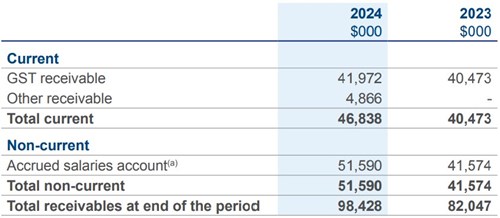

5.1 Receivables

Funds held in the special purpose account for the purpose of meeting the 27th pay in a reporting period that occurs every 11 year. This account is classified as non-current for the year before the 27th pay year.

Accrued salaries account contains amounts paid annually into the Treasurer’s special purpose account. It is restricted for meeting the additional cash outflow for employee salary payments in reporting periods with 27 pay days instead of the normal 26. No interest is received on this account.

The account has been reclassified from ‘Cash and cash equivalents’ to ‘Receivables’ as it is considered that funds in the account are not cash but a right to receive the cash in future. Comparative amounts have also been reclassified. The CCYP does not hold any collateral or other credit enhancements as security for receivables.

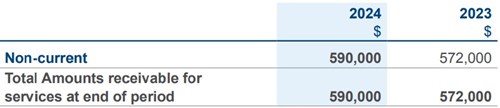

5.2 Amounts receivable for services (Holding Account)

Amounts receivable for services represent the non-cash component of service appropriations. It is restricted in that it can only be used for asset replacement or payment of leave liability.

The amounts receivable for services are financial assets at amortised cost, and are not considered impaired (i.e. there is no expected credit loss of the holding accounts).

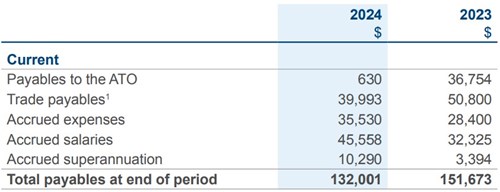

5.3 Payables

Payables are recognised at the amounts payable when the CCYP becomes obliged to make future payments because of a purchase of assets or services. The carrying amount is equivalent to fair value as settlement for the CCYP is generally within 10-20 working days.

Accrued salaries represent the amount due to staff but unpaid at the end of the reporting period. Accrued salaries are settled within a fortnight after the reporting period. The CCYP considers the carrying amount of accrued

salaries to be equivalent to its fair value.

1 Trade payables include accounts payable, credit card accruals, and inter-company payable.

6. Financing

This section sets out the material balances and disclosures associated with the financing and cash flows of the CCYP.

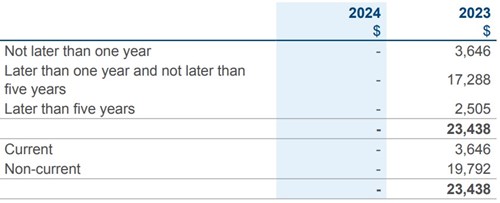

6.1 Lease liabilities

At the commencement date of the lease, the CCYP recognises lease liabilities measured at the present value of lease payments to be made over the lease term. The lease payments are discounted using the interest rate implicit in the lease which is provided by State Fleet in their calculation model.

State Fleet determines what lease payments are included as part of the present value calculation of lease liability.

The interest on the lease liability is recognised in profit or loss over the lease term so as to produce a constant periodic rate of interest on the remaining balance of the liability for each period. Lease liabilities do not include any future changes in variable lease payments (that depend on an index or rate) until they take effect, in which case the lease liability is reassessed and adjusted against the right-of-use asset.

Subsequent measurement

Lease liabilities are measured by increasing the carrying amount to reflect interest on the lease liabilities; reducing the carrying amount to reflect the lease payments made; and remeasuring the carrying amount at amortised cost, subject to adjustments to reflect any reassessment or lease modifications.

This section should be read in conjunction with note 4.2 on the previous page.

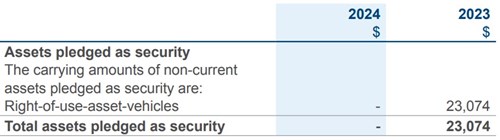

6.2 Assets pledged as security

The CCYP has secured the right-of-use assets against the related lease liabilities. In the event of default, the rights to the leased assets will revert to the lessor.

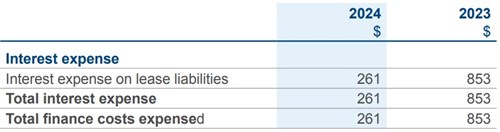

6.3 Finance costs

Finance costs includes the interest component of the lease liability repayments to State Fleet.

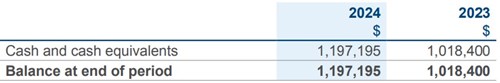

6.4 Cash and cash equivalents

7. Financial instruments and contingencies

This note sets out the key risk management policies and measurement techniques of the CCYP.

7.1 Financial instruments

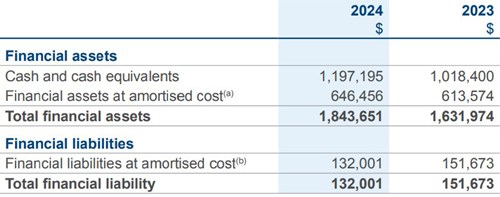

The carrying amounts of each of the following categories of financial assets and financial liabilities at the end of the reporting period are:

a) The amount of financial assets at amortised cost excludes GST recoverable from the ATO (statutory receivable).

b) The amount of financial liabilities at amortised cost excludes GST payable to the ATO (statutory payable)

7.2 Contingent assets and liabilities

The CCYP has no contingent assets or liabilities to disclose at the end of the reporting period.

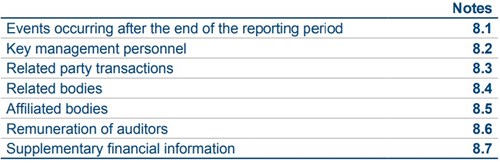

8. Other disclosures

This section includes additional material disclosures required by accounting standards or other pronouncements, for the understanding of this financial report.

8.1 Events occurring after the end of the reporting period

The CCYP had no events occurring after the end of the reporting period that impacted on the financial statements.

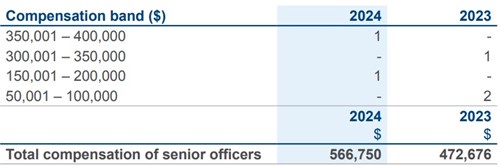

8.2 Key management personnel

The CCYP has determined key management personnel to include cabinet ministers and senior officers of the CCYP. The CCYP does not incur expenditures to compensate Ministers and those disclosures may be found in the Annual Report on State Finances.

The total fees, salaries, superannuation, non-monetary benefits and other benefits for senior officers of the CCYP for the reporting period are presented within the following bands:

8.3 Related party transactions

The CCYP is a wholly owned public sector entity that is controlled by the State of Western Australia.

Related parties of the CCYP include:

• all cabinet ministers and their close family members, and their controlled or jointly controlled entities;

• all senior officers and their close family members, and their controlled or jointly controlled entities;

• other agencies and statutory authorities, including related bodies, that are included in the whole of government consolidated financial statements (i.e. wholly-owned public sector entities);

• associates and joint ventures of a wholly-owned public sector entity; and

• Government Employees Superannuation Board (GESB).

Material transactions with related parties

Outside of normal citizen type transactions with the CCYP, there were no other related party transactions that involved key management personnel and/or their close family members and/or their controlled (or jointly

controlled) entities.

8.4 Related bodies

The CCYP has no related bodies.

8.5 Affiliated bodies

The CCYP has no affiliated bodies.

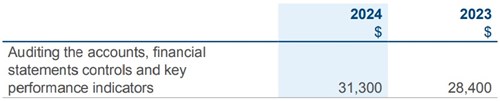

8.6 Remuneration of auditors

Remuneration paid or payable to the Auditor General in respect of the audit for the current reporting period is as follows:

8.7 Supplementary financial information

There were no losses of public moneys or other public property through theft or default during the financial year (2023: nil).

There were no write offs of public money or other public property during the financial year (2023: nil).

There were no gifts of public property during the financial year (2023: nil).

9. Explanatory statement

9.1 Explanatory statement for controlled operations

This explanatory section explains variations in the financial performance of the CCYP undertaking transactions under its own control, as represented by the primary financial statements.

All variances between annual estimates (original budget) and actual results for 2024, and between the actual results for 2024 and 2023 are shown below. Narratives are provided for key major variances which are more than 10% of the comparative and which are more than 1% of the following (as appropriate):

1. Estimate and actual results for the current year:

• Total Cost of Services of the annual estimates for the Statement of comprehensive income and Statement of cash flows (i.e. 1% of = $3,477,000); and

• Total Assets of the annual estimates for the Statement of financial position (i.e. 1% of $1,743,000)

2. Actual results between the current year and the previous year:

• Total Cost of Services of the previous year for the Statement of comprehensive income and Statement of cash flows (i.e. 1% of $3,119,108); and

• Total Assets of the previous year for the Statement of financial position (i.e. 1% of $1,701,376).

9.1.1 Statement of comprehensive income variances

9.1.2 Statement of financial position variances

9.1.3 Statement of cash flows variances

Major estimate and actual (2024) variance narratives:

1. Employee benefits expense was less than the estimate due to staff vacancies and delays in recruitment of staff.

2. Supplies and services expenses exceeded the estimate due to the use of labour hire arrangements whilst permanent vacancies were being filled, engagement of a HR recruitment agency to assist with recruiting permanent employees, and a major website update.

3. Services received free of charge are less than the estimate. This is due to no services received free of charge been provided by some agencies that had provided the services in previous financial years.

4. The CCYP transferred it’s one right-of-use-asset to another agency.

5. Employee provisions (current) is less than the estimate. This is due to the engagement of an actuary to provide an updated estimated provision.

6. The CCYP has no contract liability.

7. Employee benefits expense was less than the estimate due to staff vacancies and delays in recruitment of staff.

8. Supplies and services exceeded the estimate due to the use of labour hire arrangements whilst permanent vacancies were being filled, engagement of a HR recruitment agency to assist with recruiting permanent employees, and a major website update.

9. Other payments were lower than the estimate as some expenses for this financial year were prepaid in the last year.

Major actual (2024) and comparative (2023) variance narratives:

A Supplies and services expense was higher in 2024 due to the engagement of a professional service provider for the youth steering group.

B Other expenses were lower in 2024 due to a reduction in staff training costs as there were delays in recruitment, hiring of temporary staff and no major repairs and maintenance as compared to the previous financial year.

C During 2024 the CCYP transferred it’s one right-of-use asset to the Department of Water and Environmental Regulation in September 2023.

D Employee provisions (current and non-current) is higher in 2024 due to the engagement of an actuary to provide an updated estimated provision. An actuary was not engaged in 2023 as a different calculation method was employed.

E Lease Liabilities reduced to nil as CCYP transferred one leased pool vehicle to the Department of Water and Environmental Regulation in September 2023.

F Employee benefits payments were less than the previous financial year due to staff vacancies and delays in recruitment of staff.

G Supplies and services payments exceeded the previous financial year due to the use of labour hire arrangements whilst permanent vacancies were being filled, engagement of a HR recruitment agency to assist with recruiting permanent employees, and a major website update.

H Other payments is lower this year compared to the previous year as refund of unspent grant payments were included in the last year.

Re-read the Financial statements and KPIs chapter